Anarchy in the UK

I was in New York last week for a big crypto conference that featured a who’s who of speakers and attendees. It was my first crypto conference and I was curious about the vibe, but I would call it broadly encouraging. There was a recognition that a lot of the lots of the tourists have gone home and that the industry needs to focus on the building and hard work needed to realize all of the grand visions. Anyway, on to this fortnight’s happenings. And let’s hope our global financial system is still functioning by next issue.

🟢 Bitcoin Strikes Back

(Big Idea: Digital Gold)

It’s been an exciting week for global currency traders. Amongst other big moves, the British Pound fell 8% against the Dollar in a single day. It has since recovered much of that fall, but it sounds like we narrowly avoided a collapse of the British pension market along the way.

From the FT:

“At some point this morning I was worried this was the beginning of the end,” said a senior London-based banker, adding that at one point on Wednesday morning there were no buyers of long-dated UK gilts. “It was not quite a Lehman moment. But it got close.”

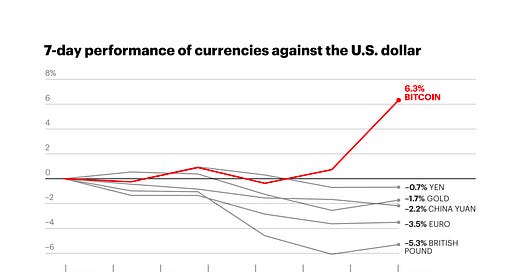

As always, Matt Levine has the best explanation and context for the crises. But what was interesting to see was that as the Pound and Euro were tanking at least some of that money was flowing into Bitcoin:

Bitcoin saw record inflows coming from the Pound and Euro, well beyond anything during Covid or as markets sold off in the spring this year:

I frequently hear two related criticisms of Bitcoin. 1) If Bitcoin is “e-Gold”, how come it doesn’t behave like gold? and 2) Bitcoin can’t really be a store of value if it’s so volatile. Both arguments are valid, but kind of miss the point. When you buy Bitcoin today, you do it not because you think it is currently a store of value, but rather because you think it could become a store of value.

Gold has had a 5,000 year run as a precious metal. All the gold in the world is worth roughly $10 trillion, with 90% of that sitting in vaults, owned by central banks and institutions, as the literal gold standard of a safe investment. Interestingly, however, even gold is behaving less like gold these days. Whether it’s because Bitcoin is slowly siphoning away some of its appeal or there are other factors at work, gold has become less of a safe harbor during turbulent times. Gold is down 6% over the last 10 years, even before counting inflation. With stocks, bonds and global currencies tanking this year along with a European war, you would expect gold to be rallying finally. Instead, its price has fallen 14% in the last six months (compared to the Nasdaq 100 down 24%).

Bitcoin is not yet ready to take Gold’s place. The market still sees Bitcoin as a “risk-on” asset. If you’re looking for safe harbors, Bitcoin isn’t there yet and won’t be for quite some time. Even just technically, it remains very hard for institutions to buy Bitcoin. It’s not like the tech stock revolution where anyone that could buy a stock could also easily YOLO into Yahoo, Cisco or Qualcomm. Neither retail nor institutions can directly purchase Bitcoin (much less ETH) in their existing accounts currently.

Bitcoin may have the potential to be digital gold eventually, but you are buying it at a discount based on its progress towards that goal. If Bitcoin became as valuable as gold, it would be worth $500,000 per coin, not $20,000. So you are basically betting that it has a 4% chance of it equating gold (much less surpassing).

We’ve had 5,000 years of gold, roughly 50 years of U.S. fiat (i.e. a dollar that is not directly tied to the price of gold) and 13 years since the first Bitcoin block. These things take time to change, but when German inflation hits 10%, it certainly opens some eyes.

🟦 And Now For Something Completely Different

(Big Idea: NFTs)

We talked a month ago about NFTs as Art. I tend to think of this as one of the clearest use cases of NFTs. Given that the main focus of the last 100 years in art has been asking “what is art,” allowing for digital ownership seems pretty obvious.

Tyler Hobbs creates “generative art”. He writes an algorithm in code that has certain rules and patterns, but allows for wide variety in the output. When “minted,” a random variable input kicks off the algorithm and produces an image. His most famous project, Fidenza, is fascinating, visually stunning and economically successful (the lowest priced work available right now is around $125,000.

His latest project, QQL, dropped this week. It is also generative and each work is completely different, but the interesting hook is that it allows the person minting the art to influence what comes out. There are about a dozen settings you can choose from, altering the color palette, the size, etc. But even with the exact same settings, two outputs can be dramatically different and all have a similar feel, clearly built by one artist. I encourage you to play with the algorithm yourself here.

On Wednesday, there was a Dutch Auction for 900 “mint passes” which granted the collector the right to an artwork in part of their own making. Settling at 14 ETH per pass, the auction netted Hobbs roughly $17 million and has generated some amazing works already:

It might not quite to the genius level of Dogs Playing Poker, but I think this is a pretty impressive use of the medium. Sadly, the auction priced above my personal “buy it solely because you love it” price point, but I can still appreciate the work and I’m excited to see the other outputs people generate.

◆ Up, Up and Away???

(Big Idea: Tokenomics)

What do you do with a project that simultaneously demonstrates both the promise and peril of crypto? Well, that’s Helium. It’s been a great example of using a token to bootstrap a network. But it has also demonstrated some of the familiar Ponzi-adjacent properties that make it hard to buy in. Given that, I have avoided discussing it to this point, but both a new announcement last week and a scathing story illustrate the duality of Helium. I’m here to keep it real with y’all (especially the ones that have read this far).

Helium is a distributed network developed to connect Internet of Things (IoT) devices. These are devices that need to check in online, but aren’t gobbling a ton of data. Maybe not your smart fridge (since that can use your home WiFi), but things that are out and about like parking meters or air quality monitors or logistics asset tracking. These are low power, longer range and lower cost devices so they don’t need the speed or bandwidth of WiFi/5G. IoT devices actually passed non-IoT devices in sheer numbers a few years ago and their growth is much faster so it’s not hard to imagine a world where these devices become massively more prevalent in the coming years.

If you want to build a network to support all of these devices, you can raise a bunch of money, purchase thousands of these devices and then negotiate leases and access rights to the physical locations to mount them. That’s kind of the traditional, top down, way to do it that we saw as AT&T, Verizon, Sprint and T-Mobile (or their predecessors) build out cellular networks, fought against dead spots and bragged about who had the best coverage.

Instead, Helium has used a bottoms-up approach to build out its network. It started out paying cash to people who installed hot spots at their homes or businesses, but it really took off when it switched to using token incentives. Users invest ~$500 for a LoRaWAN (Low-power Wide-area Network) hotspot that can cover up to 3 miles in urban areas and 10 times in rural areas. They then get compensated in Helium tokens for adding their hotspot to the network, covering unique territory and ultimately transmitting data.

This sounds like a pretty ideal example of how innovative tokenomics can bootstrap a network and get over the “cold start” problem. If we’ve learned anything in the past 20 years of the Internet, it’s the value of network effects. eBay may have started off selling Pez dispensers, but the value of the network increases exponentially as more sellers attract more buyers and more buyers attract more sellers. The challenge is how you get it started. Using a utility token is one potentially interesting way to do it.

The token becomes the currency of the network, somewhere on the spectrum from tickets at Dave and Busters to the Bolivian boliviano. End users pay for the data they use with the token, providers receive tokens for their participation and speculators investors provide capital and liquidity. In an ideal world, the early participants in the network receive larger share than later participants, in recognition of the additional risk they took and the value they added launching the network.

In Helium’s case, it definitely worked to build out the network. They currently have almost 1 million hotspots activated covering 70,000 cities and 182 countries. As an example, their coverage in Salt Lake City is pretty solid (being crypto all of the data is open and you can track every hotspot, the incentives they’ve received and the amount of data they have transmitted). The next phase for Helium is building out a 5G network. 5G doesn’t travel as far and has higher throughput requirements, but is also much more valuable. Last week, Helium announced a cell phone plan starting at $5 a month along with partnership with T-Mobil. When available, the plan will use the 5,000 currently active Helium 5G nodes, but otherwise will fall back on T-Mobile if there isn’t coverage. Over time, you could see how all of this could grow organically and become increasingly compelling.

But, of course, there’s some problems. 1) No one seems to actually be using the network. One estimate indicated that data credit usage in June was just $6,561. Admittedly, data networks like these need broad coverage before they can attract much demand, but that number is shockingly small.

2) Helium got busted for implying that Lime and Salesforce were early clients (both disavowed doing anything more than testing the network).

3) If you’re inclined toward a Ponzi argument, there’s plenty of data to support your conviction. Given the minimal actual data usage of the network, most of the tokens have been awarded for activation and verification of other hotspots. A recent Forbes article detailed how wallets connected to insiders claimed more than a quarter of the tokens issued in the first six months.

4) People that paid $500 for a Helium node, may now be earning just $20 per month with most of that coming from launch subsidies and not actual data fees.

Helium has raised $364 million from all the usual suspects with Tiger and Andreessen Horowitz leading the most recent round. It remains early. The lead time for IoT customers to test networks, update and ship can be years. In the meantime, it’s a project to watch skeptically. Because it’s open, we can track actual usage and build our own business case. Helium even helps you analyze the profitability of any specific node. Even if Helium fails, there can still be useful lessons for the broader community (see Van, Web). But I’m also pretty sure I wouldn’t put Grandma’s life savings into HNT tokens.

This Week's Freezing Cold Take

“Teenagers use of the Internet has declined. They were energized by what you can do on the Net but they have been through all of that and then realized there is more to life in the real world and gone back to that.” -December 5, 2000

As always, thanks for reading. Send me questions and please share with your crypto curious friends.