Auf Wiedersehen, Good Night

I started writing Crypto Curious just over a year ago. Much has transpired in that time. I’ve learned a ton myself and hopefully you’ve learned a bit as well. But, for now, I’ve decided to take an indefinite hiatus.

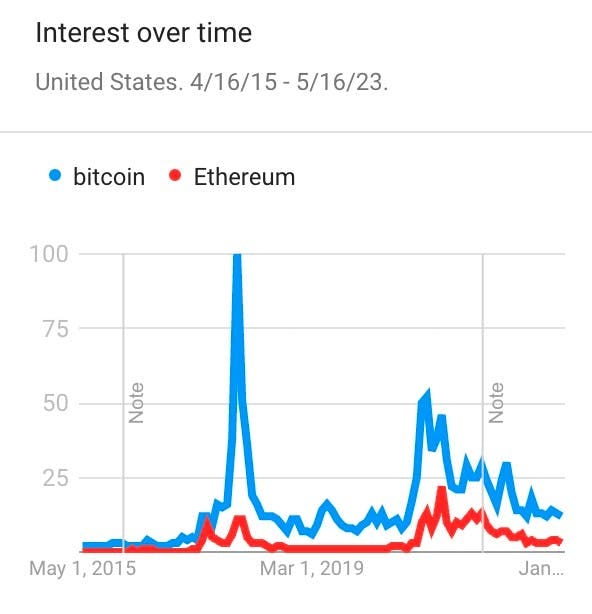

I remain as bullish on crypto as ever, but I also have to recognize that not everyone is as interested in the space as I am. While there once seemed to be an audience of people that were truly “Crypto Curious”, the current vibe is a bit more “Crypto Indifferent.” Demonstrating my impeccable timing, I launched this newsletter right at the same time “Ethereum” hit its peak search volume on Google:

Look, all of this is normal with new technologies. FOMO remains one of the strongest motivators to human behavior, and more specifically for financial enrichment or educational curiosity. The last year seems to have wrung out any remaining digital asset FOMO and we find ourselves in another crypto winter.

I cited this last issue, but I still find the Gartner Hype Cycle roundly illustrative of where we find ourselves:

Crypto is firmly in the “Trough of Disillusionment”:

“Interest wanes as experiments and implementations fail to deliver. Producers of the technology shake out or fail. Investments continue only if the surviving providers improve their products to the satisfaction of early adopters.”

Ahh, but in there remain the seeds of hope, namely, “the satisfaction of early adopters.” You don’t need the early majority to climb the slope of enlightenment while avoiding the ROUSes. Crypto continues to have a rabid, dedicated group of early adopters. Bitcoin has discovered new, controversial uses in the past six months and transactions are at all time highs. Ethereum has pulled off major improvements seamlessly and appears to be on incredibly sound economic footing. Ethereum Layer 2s are adding capacity and reducing costs as they roll out and mature. And newer chains like Solana and Cosmos are pushing the limits of performance and capabilities.

So before I take my pause, I want to remind you of some of the truly unique properties of crypto that make it such an interesting and significant innovation:

Decentralization: At its core, the whole point of a blockchain is that no one party has control. Bitcoin is the oldest and most decentralized blockchain. Anyone in the world, from mutual funds to arms dealers, can freely transact on the network. On Instagram, Facebook controls who has access, what is allowable to post, what ads are shown, what revenue share is received by creators. There are pros and cons to both models. Centralized services are much easier and faster to launch, change and control, but also tend to be more linear in what they can accomplish. Decentralization is harder, messier and slower, but because of its other benefits, it tends towards the geometric in its progress.

Digital scarcity: With decentralization comes a concept that has not previously been technically possible: digital scarcity. In the analog world, some measure of scarcity is enforced by the nature of being physical. There is only one Mona Lisa. Even if you make a high-quality print of the Mona Lisa, those are limited by paper, ink, distribution, etc. In the digital world, however, these limitations go away and items can be instantly copied endlessly. There is no appreciable limit to the number of identical copies of a Taylor Swift recording. Crypto allows, for the first time ever, the combination of these two: all of the benefits of being digital combined with the uniquely critical constraints of scarcity. Independent, verifiable “money” like Bitcoin could never exist previously. Why would you trust a centralized party like Facebook or Google to not just print endless amounts of money for themselves? But with Bitcoin, the platform itself creates trustlessness, you need not trust any counter party since the platform enforces it inherently and you retain the ability to verify at any time.

Credible neutrality: Decentralization also means that there is no gate keeper to control who is or isn’t allowed to build on your environment. In their early days, both Twitter and Facebook courted developers to build on top of their platforms, only to later say, “Ennn, never mind,” and shut off access overnight. If you want to build on Ethereum, there is no one to give you permission and no one to shut you down (and whether your local government allows such things is up to you to determine).

Composability: Since most of us are consumers of the Internet, we end up with a very different view from the developers who build the products we use and thus massively underestimate the value of open source software. The closer a product is to “builders” vs. “consumers,” the more likely it is to use open source software. For example, I’m guessing most of you don’t run you own web servers and may not know that 90% of web servers are based on open-source code. WordPress, also open source, has 63% of the market share for content management systems and runs 41% of all Internet sites. Because it's open source, developers can easily build, use and sell plug-ins that extend WordPress’ capabilities in thousands of ways that a core development team never could. “Composability” is built-in to crypto. Uniswap, the biggest on-chain “exchange” exists primarily as a base-level protocol that any developer can call at any time to swap one asset for another. Developers can build their own tools that take this ability for granted and, in turn, other developers can build on top of those tools. In DeFi, this ability is called “money legos” where a specific tool becomes a building block with capabilities force multiplied beyond any single tool. Over time, this becomes more and more valuable as these layers of tooling and advancements build up.

Integrated payments: The Internet consists of essentially three open protocols: TCP/IP for traffic, HTTP for web pages and SMTP for e-mail. Beyond that, everything is custom and proprietary. You can’t send a Slack message to Skype or Teams because there is no open, accepted standard for that. It is a very thin stack with a ton built on top and, notably, the Internet also does not have a built-in payment structure. Crypto does. Most every crypto platform has the ability or, usually, the requirement for a transaction to include some portion to be paid as a fee. How they work and where they go is determined by the platform and the participants, but it enables unique use cases that might not be feasible by trying to bolt Visa or Venmo on to an existing infrastructure.

Now clearly, many of these attributes have both advantages and disadvantages. For example, the built-in payment methods to crypto have made many early platforms and applications overly focused on token price and economics and susceptible to volatility and manipulation. It is rare that any new development is universally good. But, these attributes in combination with each other, time and creativity, have the potential to create new, unexpected and exciting applications. Just as the Internet powered a world of change, but positive and negative, than we could have scarcely predicted in 1995.

As for regulation, as I’ve written before, much of my frustration with the U.S. vying to create the most anti-crypto regulation in the world stems from the fact that, at its heart, crypto feels deeply American to me. As much as the United States may veer from its founding ideology, there are principles that are more deeply rooted in this country than anywhere else: freedom, individualism, state’s rights, entrepreneurship. Crypto is the technological embodiment of these ideals. Sure, crypto throws in some other American traits like self-promotion, hucksterism and profiteering, but it’s not an accident that the U.S., despite its flaws, continues to have the most advanced, creative and resilient economy. I continue to believe that these values will win out over time.

In the meantime, there are smart, talented teams around the world that continue to build the foundational pieces, the tools and protocols and the early applications that will spark the next big wave of crypto. Having been in tech for more than 25 years, I have lived these cycles before. In the middle days of the Internet, I recall regular proclamations that “this is the year for mobile.” And then the following year, people would say, “Oh, no, this is actually the year for mobile.” And then the following year, people would say, “Oh, no, this is actually the year for mobile.” Then, almost all of the sudden, mobile was just part of our lives and whole generations can’t barely imagine the world any differently.

I will continue to closely follow the crypto universe. I have no plans to sell my current holdings and I still believe this is a generally excellent time to buy in (I can offer simple portfolio suggestions for those interested). I may send additional updates from time to time and I remain available to all of you if you have questions or things you need help with.

WAGMI (“we’re all gonna make it”), my frens.

This Week's Freezing Cold Take

“The idea of a personal communicator in every pocket is a pipe-dream driven by greed.”

– Andy Grove, Intel CEO

As always, thanks for reading. Send me questions and please share with your crypto curious friends.