Here Comes the Run

Whoa. I was definitely getting FTX flashbacks last week: News flying fast, lots of drama, uncertain outcomes. But this time the screen writers added in some panicked all caps Tweets to help narrate so that was fun and new. Anyway, given the week we had, this will be an all regulation issue. We’ll talk about crypto banking, some crypto legal wins and then what it all means.

🟢 That Was The Banking Week That Was

The First Domino

Last Wednesday, Silvergate Capital announced an “orderly wind down.” Silvergate was probably *the* leading crypto bank, most notably providing on and off ramps from the traditional banking system to crypto companies. Virtually all of the major players used Silvergate: Coinbase, Circle, Paxos, Gemini, Galaxy, even FTX before they went down. The week prior, Silivergate had shut down the Silvergate Exchange Networks (SEN). SEN was a 24/7 instant settlement service that allowed the bank’s clients to transact any time, including nights and weekends when wires don’t work. This was critical infrastructure in a world where crypto trades endlessly around the clock.

Silvergate presaged the exact Silicon Valley Bank playbook. Its deposits were not very well diversified and exposure to crypto hurt as the market fell in the spring and then dealt with the fallout from FTX. Customer deposits plummeted 68% in Q4. To meet withdrawlas, Silverage had to sell debt early in a rising interest rate environment, causing a loss of $718 million.

There does seem to be evidence, however, that Silvergate was a political target due to its significant role in the crypto ecosystem. Elizabeth Warren specifically targeted Silvergate earlier this year, essentially blaming them for FTX and, later, criticizing a loan they received from the Federal Home Loan Bank of San Francisco. In the end, it was Silvergate’s early repayment of that $4.3 billion advance that left them short on cash and triggered the bank’s demise. The FHLB has since come out to say they did not “force” force Silvergate to repay the loan, but it seems odd that the bank would choose to self immolate. I suspect there is mostly some fine parsing of the word “force” going on here, but at least all depositors got their money back without the FDIC getting involved.

The Big Kahuna

While Elizabeth Warren seemed to celebrate Silvergate’s closure, the move also helped catalyze concern around Silicon Valley Bank. The run on SVB has been covered extensively everywhere so I will not repeat much, other than to point you to Matt Levine, who, as always, has the most concise and entertaining analysis.

As for crypto, my understanding of SVB’s role in the crypto ecosystem was that it was much less important in the onramp/offramp rails that support the movement from fiat to crypto, but more a place where crypto companies happened to bank. Ripple, Yuga, Pantera, etc. all had exposure and many others are the the high-tech-y companies likely to bank at SVB. Notably, BlockFi, which is going through its own bankruptcy, held $227 million with SVB. But maybe no one topped Circle, the company behind the USDC stable coin which had $3.3 billion in reserves at SVB (we’ll come back to that).

But, after some VCs started the run and others threw gas on the fire, by Sunday evening, the Feds had stepped in and SVB had turned into the “safest of any bank or institution in the country.”

The Footnote

But at the same time the FDIC announced they would step in and backstop SVB depositors, they quietly shivved another crypto bank. Almost buried in the press release was that Signature Bank “was closed today by its state chartering authority.” This came as a surprise to many people, including Barney Frank, a Signature board member and the author of the Dodd-Frank Act which rewrote banking regulation in 2010.

Signature had become a significant player in the crypto world (it’s the bank I would have used for a crypto fund). Similar to Silivergate, it had its own private network, Signet, that allowed 24/7 payments. But its primary focus was on New York real estate and professional services firms. “Digital asset-related client deposits” made up roughly 20% of the firm’s deposits.

Signature had certainly seen significant withdrawals on Friday, but, apparently, the Department of Financial Services in New York never claimed the bank was insolvent. Frank insists that the bank would have been operational on Monday had it been allowed to open.

So why was Signature closed? According to Frank:

“I believe it was probably to send the message that even though we were doing crypto stuff responsibly, they don’t want banks doing crypto. They denied that in their statement, but I don’t fully believe that.”

The plot thickened yesterday when, according to Reuters:

“Two sources added that any buyer of Signature must agree to give up all the crypto business at the bank. But an FDIC spokesperson told Reuters after publication that the agency would not require divestment of crypto activities as part of any sale, and pointed to prior comments from FDIC Chairman Martin Gruenberg that the agency is not looking to prohibit any particular activity by banks.”

Hmm. We will have to see what happens with Signet, but for the time being, the FDIC is operating an important piece of crypto plumbing. Go figure.

The Contagion

The irony of all of this is that in the midst of trying to kneecap crypto, the traditional banking system seems to have suffered concerning damage. Meanwhile, the failures of the crypto world in the last year (Luna, Celsius, FTX, etc.) never even registered a blip on the traditional financial system. The inverse, however, is not true and wobbles at SVB flustered crypto.

As mentioned, Circle runs USDC, the gold standard of stablecoins. Each month, Circle dutifully publishes its list of assets down to the individual CUSIP of the Treasuries it holds. 1 USDC is always redeemable for $1, with the one wrinkle that you can only move to the traditional fiat world when the fiat world is open and operating (i.e. M-F, 9-5).

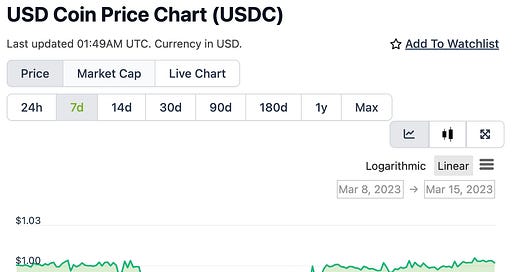

On Friday night, Circle Tweeted that roughly 8% of their total reserves ($3.3B) were at SVB. Like many others, they submitted wires on Thursday, but didn’t know the status of them a day later. Crypto markets immediately (over)reacted and USDC fell from it’s normal price of $1 as low as $.88. DAI, an algorithmic stablecoin that holds crypto assets as collateral, also fell to $.89 since it has significant holdings of USDC.

Traders, including yours truly, were like, “Cool, I can buy a dollar for 90 cents,” and rushed in to buy what USDC they could. Tether, USDC’s sketchier stablecoin brother, was suddenly in high demand. Its price rose to $1.02 and DeFi lending pools like Compound and Aave were drained of all available Tether.

Saner heads relatively quickly prevailed and Circle resumed conversions when the old-school world opened Monday morning. And, for now, a dollar is worth a dollar once again.

🟦 Hitting Singles

The week before the banking madness kickass off, crypto notched up some forward progress on the regulatory front. Broadly, regulators main advantage is one of intimidation. By making a small number of public rulings, they hope to deter thousands of others: “That’s a nice bank/crypto project/monkey JPEG you got there. I would hate to see something happen to it.” While there are a lot of advantages to this strategy, the Feds are vulnerable in the courts where a single ruling can set precedent and reverse years of wandering enforcement. In the past fortnight, we’ve seen this at work with two different court cases.

We’ve talked a lot about efforts to launch a spot Bitcoin ETF and how the SEC has steadfastly refused. Greyscale has gone to court to overturn these rulings and the early questioning from the U.S. Court of Appeals for the D.C. Circuit were encouraging for Greyscale.

So far, the SEC has approved a futures based Bitcoin ETF because futures are traded on markets regulated by the CFTC, but has not approved a spot ETF arguing that the spot markets are subject to manipulation. The judges found this distinction questionable. Judge Rao:

“What the Commission really needs to explain is how it understands the relationship between Bitcoin futures and the spot price of Bitcoin because it seems to me that these things, I mean, you know, one is just essentially a derivative of the other. They move together 99.9% of the time.”

Judge Rao and Judge Srinivasan then pushed the SEC repeatedly on the grounds on which it approved a Teucrium futures based ETF and how this situation is different and directionally had many more critical questions for the SEC then for Grayscale. Obviously, this is just questioning, not a decision, and a ruling is likely still months away. Even if Grayscale wins this round it doesn’t mean GBTC can automatically convert to an ETF (there could be appeals or denials on other grounds), but it is a trend in an encouraging direction.

Meanwhile, the Southern District of New York chalked up a small win for the crypto community. Binance.US had agreed to buy the assets of Voyager Digital, a crypto brokerage, for $1 billion after it had gone bankrupt. The SEC had aimed to stop the purchase over concerns and just kind of general dislike of Binance.US. But Voyager customers had voted 97% in favor of the deal and the judge ultimately agreed, allowing the transaction to go through. In the process, Judge Wiles was unkind to the SEC:

“Although the SEC contended that the Debtors somehow had to prove a negative… the SEC had not even affirmatively contended that the Debtors were doing anything wrong, or that Binance.US was doing anything wrong. Nor had the SEC offered any guidance at all as to just what it was that the Debtors allegedly were supposed to prove on these issues, or how the Debtors possibly could prove what the SEC wanted them to prove without receiving any explanation at all from SEC as to just why the Debtors’ operations, or Binance.US’s operations, might raise legal issues."

I mean, that’s a pretty good summary of the SEC’s relationship to crypto: We’re going to punish you for doing wrong, but we’ll give you no guidance on what you’re doing wrong and no details on how to prove what you're doing isn’t wrong.

The judge added more:

"There are firms that operate as cryptocurrency brokers or exchanges, and have done so for several years, without being subject to clear and well-defined regulatory requirements. Regulators themselves cannot seem to agree as to whether cryptocurrencies are commodities that may be subject to regulation by the CFTC, or whether they are securities... subject to securities laws, or neither, or even on what criteria should be applied in making the decision."

This is a small ruling in a minor case, but it shows a trend and a possible check on the SEC that judges a) seem to be able to get up to speed pretty quickly on some of the complex issues in crypto and b) have shown very capable in finding the holes in the SEC’s arguments.

◆ Where We Go From Here

So where does all of that leave us? I find myself oddly optimistic on crypto’s prospects after the past two weeks.

In banking, I think it is clear that we will see a) more consolidation and b) more regulation. Matt Levine cited a Twitter user who commented:

There are two main ways to increase concentration in the banking sector

1. Let big banks acquire troubled banks

2. Don’t let big banks acquire troubled banks

The U.S. has deemed four banks too big to fail, meaning no matter how many fake accounts they open, depositors will never lose their money. First Republic is being shorn up by those Big 4 banks today, but I don’t think anyone would be surprised if it ended up being swallowed up altogether along with any number of other regional banks that may find themselves on shaky ground (i.e. option 1 above). And after last week, both businesses and now consumers are asking themselves why they would bother banking anywhere else, pulling more and more deposits from any non big 4 bank and instead parking them at a systemically important financial institution (i.e. option 2 above). Sure enough, Bank of America has pulled in more than $15 billion in new deposits in just a few days after SVB’s collapse.

By design, no bank can survive a full run. That’s sort of the point of the “fractional” part of the banking system. In the olden days, you could literally tell your tellers just to slow play customers withdrawing their money. Just watch George Eccles describe their playbook for avoiding bank runs:

Go back and check the signature, even though you know your friend John Jones, just to delay time. And when you pay the money out, we're not going to pay in $100 bills. We're going to pay in five, tens, twenties and we're going to count it out twice.

Even in 2008 bank runs happened much slower. When Washington Mutual failed, $16.7 billion flowed out in 10 days. This time, SVB saw $42 billion flow out in 24 hours! I don’t care how well capitalized you are, that’s a lot of money moving very quickly.

Our financial regulation lives in a world based on the Bailey Savings and Loan and rules coming out of the Great Depression. But live in a world where you can read a Tweet while waiting for your dentist, fire up your bank's mobile app and have successfully wired out millions of dollars before the hygienist has been put that fluoride goop on.

And this increased consolidation is bound to come with new regulations. We’ve gone from insuring $250,000 of deposits to, for the time being, essentially insuring an unlimited amount of deposits. I don’t think we are going back.

There seems to be an emerging consensus that a CFO should probably not be required to calculate the weighted average maturity of a bank’s Treasuries before opening a bank account. This goes double for consumers. Equity holders should still need to do that analysis before buying shares in a bank, but depositors just want somewhere to safely stash their money and process transactions.

But to provide unlimited coverage (or much higher limits), the FDIC will surely need additional ways to monitor, assess and control risk in the system. And this added regulation will almost certainly continue to increase consolidation.

So how does any of this affect crypto? Well, 1) crypto is still alive and moving forward through all of this. After all of the events of the past 12 months, this is a bit of an accomplishment. In the four months post-FTX to actually be able to show a few wins against the SEC and not to have been, like, banned completely? I’ll take that. Josh Hannah taught me seven years ago that “every day that Bitcoin doesn’t die it gets a bit stronger.”

2) Crises spur change and reflection. Much of what is going on points out the value, or at least, the possibilities of crypto: self-custody, instant transactions 24/7, fast settlement, transparency, open protocols, etc. Our financial system is a complex, layered interaction of thousands of components and actors so I’m not suggesting that crypto will magically or suddenly replace them all. But as crypto continues to mature and the turmoil from our unique post-Covid/ zero-interest rate environment unfolds, there will be opportunities for change.

The first Bitcoin block was mined in January 2009, shortly after the Global Financial Crises. It included a quote from the British newspaper The Times: “Chancellor on brink of second bailout for banks.” It is not surprising that Bitcoin has surged in the days after SVB. It at least has people reconsidering and asking some new questions.

3) Technology is not universally good, but it is largely unstoppable. Regardless of what happens with U.S. regulators, crypto will continue to innovate around the world. Nothing that we’ve seen in the last week leads anyone to believe that Citi is suddenly going to create new, interesting products, much less make their UI any less disastrous. Banking will lumber on while crypto will race ahead. The gaps between the two will continue to grow, further illustrating all of the unique attributes that crypto entails.

This Week's Freezing Cold Take

Jim Cramer may just be a permanent fixture here, but it’s still just so remarkable.

February 8: Silicon Valley Bank is “still cheap” and has been “driven artificially down.”

As always, thanks for reading. Send me questions and please share with your crypto curious friends.