It's Gonna Be May

Apologies for the one day delay in this issue, but between the second largest bank failure of all time and the government announcing that it won't be able to pay its bills in a month, it was a busy day. But, yeah, things are going pretty well in global finance. At least we have JT to welcome in the new month. On to it.

🟢 Europe: Cradle of Innovation

Big Idea: Regulatory Competition

Last week the European Union approved broad crypto legislation around Markets in Cryptoassets (MiCA) with various provisions coming into action over the next two years. I dunno about you, but I don’t always look to EU Commissions for my reasonable, balanced regulation, but maybe I need to adjust my priors. Crypto advocates are still grumbling, but MiCA seems to be a step forward to pragmatic crypto regulation that seems to be winning out around the world except for here. What’s in it?

Any company that wants to offer crypto services will need to register in one EU country, but that will allow them to operate across the rest of the EU.

Issuers of cryptoassets will have disclosure and transparency rules and will also need to comply with anti-money laundering regulations and security standards.

Stablecoins must maintain ample reserves in the event of mass withdrawals.

Regulators will have the ability to restrict or ban specific crypto platforms based on investor protection or market stability.

Firms will need to disclose their energy consumption and environmental impact.

DeFi (all of the financial parts of crypto like lending, derivatives, etc.) and NFTs were beyond the scope of MiCA and will be addressed in future rule-making sessions.

There are still many question marks. And some of the vague issues could become highly problematic as they get implemented over the next two years. But what is notable is what it doesn’t do. For starters, it doesn’t attempt to ban crypto (no anti-crypto Armies in Europe I guess). The stable coin regulations also seem to pretty explicitly allow their existance, a stance I would not have fully expected from the EU.

The regulatory framework also leaves leeway for individual member states to implement and enforce rules differently. Portugal was early out of the gate in adopting a crypto friendly with a zero percent capital gains rate on crypto assets, but they have since announced a change in policy and have pulled back. In some sort of Bizzaro world, the Dutch who allow weed, prostitution and mayonnaise on French Fries, claim they will be strict. Meanwhile France, the country that regulates the English language and the price of baguettes, is trying to become a crypto hub. France has already passed their own crypto framework and Circle, who runs the USDC stable coin, chose Paris to be the headquarters for their European efforts.

There’s definitely a vein of Crypto bros who are convinced that global competition between governments around the world will provide a check on regulation. The theory is that crypto is inherently borderless, so talent and capital will flow to the regions that develop stable, friendly regulation. I’m more skeptical of this theory; I’m pretty sure my wife is not letting us move to Montenegro to start an NFT exchange. But it is likely that we will see some interesting effects around the edges. Especially in an open border region like the EU, this could produce some interesting examples for other governments to follow.

🟦 Gensler Testifies

Big Idea: Regulatory Stagnation

Meanwhile, back Stateside, SEC chair and recent crypto villain Gary Gensler testified before Congress for the first time in 18 months. A lot happened in that time, but the blow up of FTX and Republicans taking control of the House were probably the most notable underlying changes in the questioning this time.

Republicans were not happy with Gensler. One, Warren Davidson of Ohio, introduced a proposal to have Gensler removed as SEC chair. House Financial Services Committee Chairman Patrick McHenry pressed Gensler on regulation by enforcement: “Your approach is driving innovation overseas and endangering American competitiveness… Regulation by enforcement is not sufficient nor sustainable. You’re punishing digital asset firms for allegedly not adhering to the law when they don’t know it will apply to them.”

Some highlights:

Gensler has multiple times said everything except Bitcoin is a security, but when asked directly if Ethereum is a commodity or a security, he refused to answer, dancing around the question repeatedly.

Gensler remains of the opinion that existing laws work just fine for crypto, encourages the industry to just “come in and register” and firmly put the blame on crypto firms for choosing to be non-compliant.

When asked if he had directed staff to look at FTX, he said the SEC had investigated “a wide range of crypto intermediaries” and took credit for filing actions two months after the collapse of FTX.

And despite having taught a class at MIT on “Blockchain and Money,” Gensler said he has never owned or used crypto, an interesting admission that perhaps explains some of his positions.

Did the questioning or Gensler’s testimony change anyone’s mind? Unlikely. But increased pushback is a continuation of the trend that we have noted here previously. Coinbase, which has been the most regulatory compliant crypto company, continues to amp up their fight with the SEC. Last Thursday, they published a 73-page response to the Wells Noticed they received last month. The response questioned the SEC’s legal basis (“the Staff’s laundry list of proposed charges all rest on three primary legal theories,each of which is flawed and untested”) as well as the impacts on the SEC’s reputation of investor protection (“If the Commission had believed in April 2021 that Coinbase’s core businesses violated securities law, it would have been required by its own mandate to prevent the S-1 from becoming effective to protect the investing public.”)

In the meantime, Coinbase is covering its bases and is setting up shop in Bermuda (maybe I can sell the family on that one). They were recently approved for a trading license there and will soon launch a perpetuals exchange, a highly active area that Coinbase had previously ceded to competitors. As for whether the regulatory environment would force Coinbase to leave the U.S., CEO Brian Armstrong said, “Anything is on the table, including relocating or whatever is necessary.”

◆ Double Dipping

Big Idea: NFTs

Finally, let’s check back on some NFT projects that we have discussed previously as two big brands that have dipped back into the NFT well: Starbucks and Trump. Let’s start with the green mermaid. Starbucks announced plans to launch NFTs last fall without ever calling them NFTs (instead “journey stamps”) or talking about the underlying technology. The first batch of 2,000 launched in March, priced at $100 each, were payable by credit card or crypto and sold out in under 20 minutes. I learned that she’s a siren and not a mermaid (my apologies to both communities) as she was the focus of the art in that collection. Those stamps are currently selling around $500.

Last week, Starbucks launched a second drop, this one featuring their “First Store” and offering 5,000 NFTs Stamps this time. A pre-sale was limited to people who owned two of the Siren Stamps, but the collection still hasn’t sold out 12 days later. Buying a stamp gets you points along your Starbucks Odyssey. One stamp is roughly enough for a virtual coffee class while two literally lets you name a coffee tree (I would recommend “Treey McTreeface”). [Relatedly, Boba Guys has teamed up with the Solana Foundation to launch their loyalty program on the Solana blockchain, backed by a $100,000 grant.]

While Starbucks sells NFTs to Latte Liberals, Donald Trump has gone back to his fans for round 2. The first batch of 45,000 Trump NFTs sold out quickly back in November, with total proceeds well over $4 million. It is perhaps not surprising that we would see a second go-round. Luckily, he kept the price the same:

“I could have raised the price MUCH HIGHER, [and] I believe it still would have sold well, with a lot more money coming to me, but I didn’t choose to do so. I WILL BE GIVEN NO ‘NICE GUY’ CREDIT?”

This batch is ever so slightly larger at 47,000 (!), but features some of the same great artwork as the original:

Interestingly, the perks associated with the first batch (a chance to win dinner at Mar-A-Lago, Zoom calls with Trump, etc.) have been mostly dropped this time around. The release of the second batch also immediately tanked the price of the first batch as resale prices fell 68% immediately after the announcement.

Look, is any of this the future of NFTs? God I hope not. If it is, then crypto is NGMI (not going to make it). The crypto world is currently a spectrum of pure scams, quasi-grifts, memes (which feel like grifts to old people like me, but seem to have lasting consumer affection), sincere attempts to build and amazing displays of technical innovation. I suspect that Starbucks is a little more sincere in its attempts to build something interesting and useful and that companies like that will continue to test, iterate and innovate in new forms of ownership and benefits. Much of what we will see right now just looks simple and dumb, but they feel to me like baby steps on the way to something bigger.

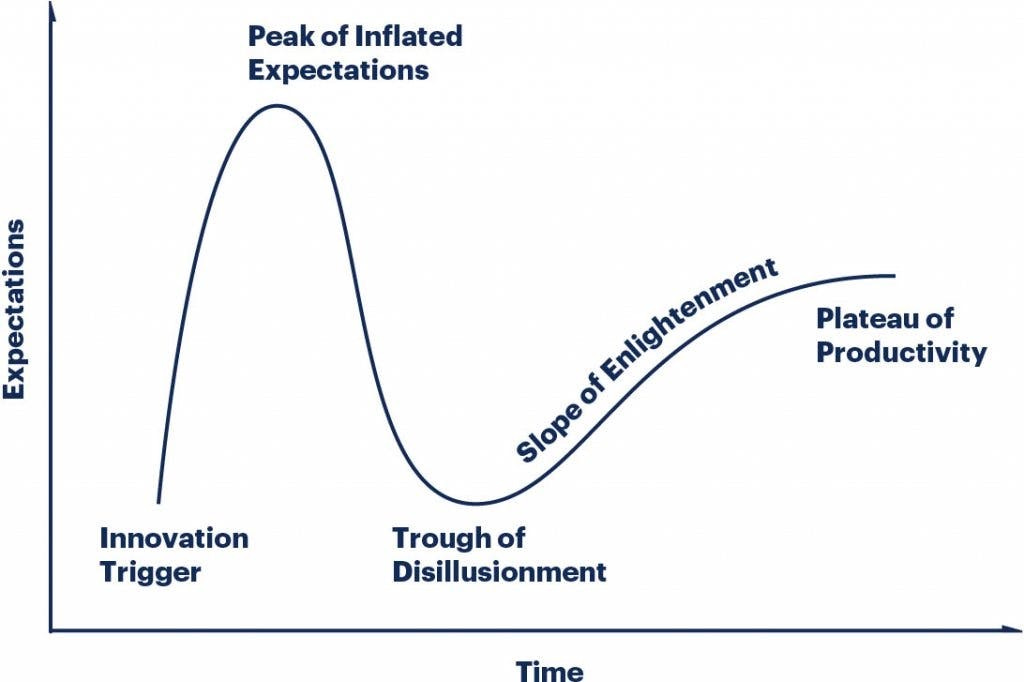

As pointed out yesterday, the traditional hype cycle can be hard to recognize when you are in the midst of it:

“You do realize that AI is currently at the Peak of Inflated Expectations and crypto is at the Trough of Disillusionment and social media is at the Plateau of Productivity, right?”

This Week's Freezing Cold Take

-Gary Gensler on October 1, 2018, current head of SEC who has since declared everything but Bitcoin a security.

As always, thanks for reading. Send me questions and please share with your crypto curious friends.