SOL Rising

I gotta get this out so I can go watch the next episode of the Adventures of Taylor & Jason. First, we’ll quickly recap the Bitcoin ETF launch. Then, we’ll introduce Solana, the blockchain du jour.

🟢 Bitcoin ETF Launched

As predicted last issue, 11 Bitcoin ETFs were approved on January 10 and started trading the next day. By most measures, the launch was wildly successful. Both Blackrock and Fidelity are nearing $2 billion in assets already, trading spreads have been narrow and the NAV discounts/premiums have largely gone away.

Meanwhile, the price of Bitcoin has fallen roughly 10% since the launch. Speculation is that much of this is coming from investors who are finally able to sell their GBTC shares near NAV par value. Indeed, the FTX estate sold roughly $1 billion of GBTC and GBTC has seen total outflows of almost $5 billion. Much of that has likely been recycled into other, lower cost funds (something I personally did with my retirement holdings), but surely some investors cashed out and took their gains or their lumps as the case may be.

One interesting wrinkle: I talked last time about how the launch of Bitcoin ETFs will turn mainstream investment companies into crypto. Old school Vanguard is apparently having none of it. They made the decision not to allow customers to purchase any of the Bitcoin ETFs because it’s too volatile and speculative. Vanguard will let you buy a 3x leveraged Big Oil ETF or an inverse 2x Gold Miners ETF, but if you want to own the best performing asset class in 7 of the last 10 years, you’ll have to take your business elsewhere. You do you, bro.

🟦 Solana’s Time in the Sun

While Bitcoin was the crypto OG, Solana is the latest mainstream darling. While there are literally hundreds of “L1” (base layer) blockchains, Bitcoin, Ethereum and Solana have established themselves as the Big Three, each with their own focus:

Bitcoin ($826 billion market cap): Slow, steady: digital gold.

Ethereum ($272 billion): The most popular blockchain to actually do things.

Solana ($41 billion): Fast and cheap.

But whereas Bitcoin and Ethereum were founded and built by crypto idealists, I think it’s safe to say that Solana has always been much more pragmatic in its approach, both in terms of what it’s built, how’s it marketed itself and the economics behind it.

It’s an interesting proxy for the evolution of crypto. Bitcoin was launched by an unknown figure who holds approximately $50 billion of tokens that have gone untouched for over a decade. And to this day, Bitcoin core developers remain philosophically stubborn steadfast.

Ethereum was created by Bitcoin refugees who wanted to be able to do more with a blockchain. They actually raised a little bit of money way back in 2014 to fund their work ($18 million in a public coin sale (ICO)), but the ethos remains more research driven and a bit idealistic. Vitalik, the heart of Ethereum, continues to bang out incredibly thoughtful posts on crypto and seems capable of reasonableness and nuance that is uncommon for any public figure.

Solana, on the other hand, has been professional from the get go. They’ve raised $374 million in multiple VC rounds and it has been a smashing success for those investors. At today’s prices, investors in their seed round were sitting on a 2350x return! If you had bought the public token sale on CoinList, you would have been looking at an 427x return. Of course, it’s crypto so it’s volatile and if you bought at the peak of the last cycle, you’d be down 60%.

Solana has taken some pretty justified criticism for being a VC token that has been dumped on an overly enthusiastic and gullible audience. The best example of this is the “The All In” ding-dongs joking about dumping Solana on the public literally one week after it’s all time high.

◆ Eating Glass

But to its credit, the Solana team has continued to grind away and they have been focused and intentional about how it wants to build. In terms of building, they’ve focused in two areas:

Strong tech + Good marketing = Success

And the tech is impressive. Anatoly Yakovenko, the founder and heart of Solana, came from Qualcomm. Solana innovated “Proof of History” which was heavily influenced by the techniques that Qualcomm used to squeeze extra bandwidth out of cell phone signals. From the earliest days, Yakovenko aimed to create a blockchain that was fast enough to run a central limit order book like the Nasdaq, a goal well beyond Etheruem’s capabilities.

Solana launched in 2020, five years after Ethereum and eleven years after Bitcoin, benefiting from all those years of learning. Things have been rocky, but steadily improving. A number of times, Solana just outright crashed, once for 17 hours, and the network basically had to be treated like your PoS Comcast modem: turn it off for 30 seconds, restart and hope for the best. But they’ve now gone 336 days without an incident and the network has been highly performant.

While Ethereum might process around 13 transactions per second, Solana has been doing almost 800 transactions per second. An ETH block takes about 12 seconds whereas a Solana block is under half a second. And if an Etherueum transaction fee might average $5, Solana transaction fees are just fractions of a penny.

And while the technology stands out, Solana has also been deliberate about its marketing, most notably in building and supporting a developer community. The Solana Foundation has used much of that VC money to run events, fund initiatives and actively communicate with developers. They’ve run regular Hackathons that continue to grow in submissions, they set up “Hacker Houses” around the world, and run an annual convention that brought in 3,000 people last year. In turn, this has helped Solana build one of the largest and most active developer communities in crypto.

None of these ideas are new to tech. Dreamforce is so big it shuts down San Francisco city streets, but Salesforce is a $280 billion dollar centrally run company, not a decentralized, distributed blockchain. In the crypto world, Solana’s relative centralization has been a big knock on it. Given Solana’s speed, the technical requirements to become a validator (i.e. to check and authorize transactions) are significant. In the Blockchain Trilemma (security, scalability or decentralization), Solana heavily over indexes on scalability. Proponents argue that it will become more decentralized over time while pragmatists might argue that “sufficiently decentralized” is good enough.

◆◆ Solana Usage

Ok, sounds good. But what can you actually *do* with Solana? Uh, maybe let’s check back on that in a few years. For now, it’s a lot of the same things that you see on Ethereum and other chains: stablecoin transfers, swapping tokens, NFTs and some light DeFi (decentralized finance).

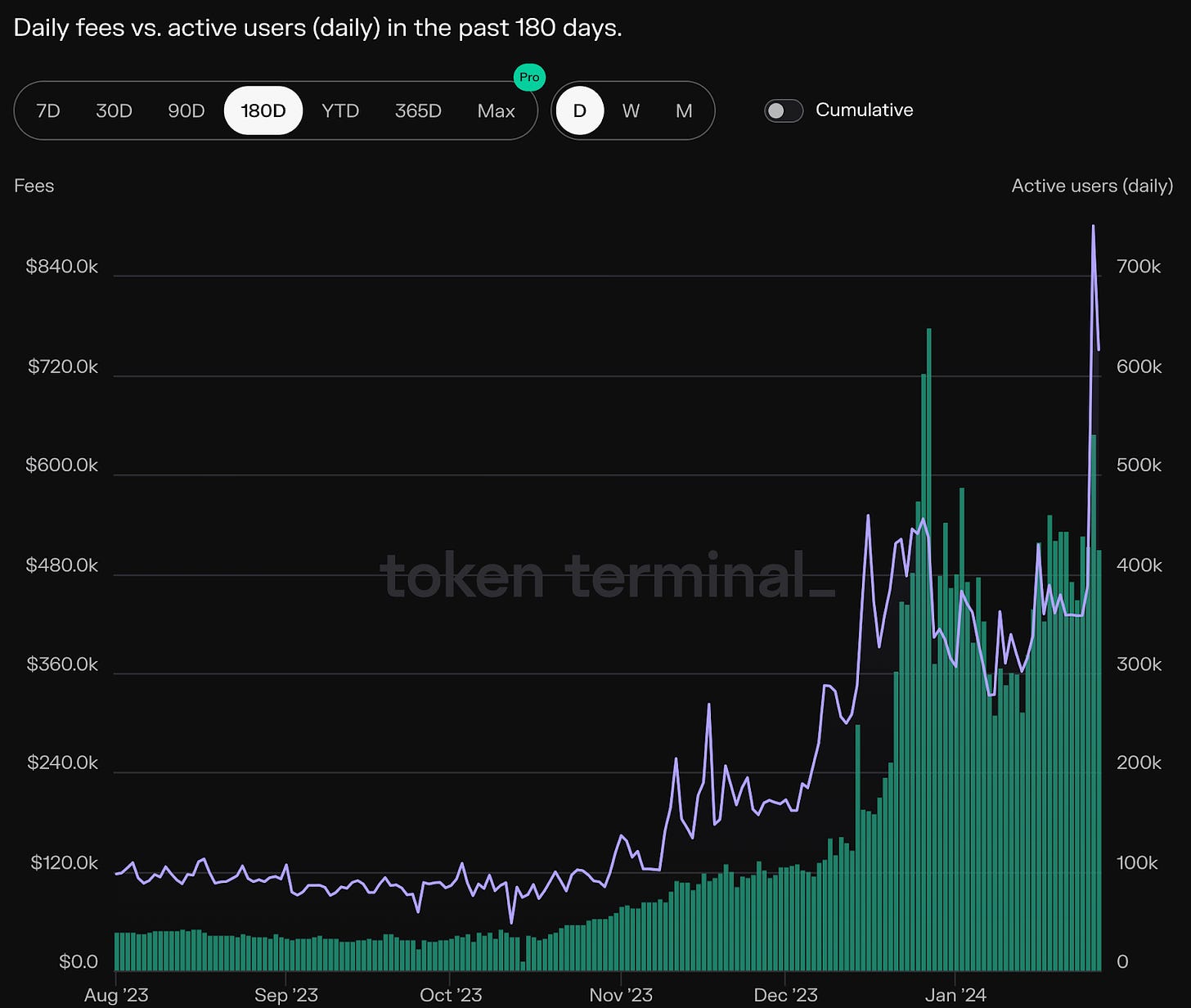

Certainly it looks like *someone* is using Solana as fees paid and active users have jumped significantly in the last six months:

Two projects of note are more unique and ambitious: Helium and Hivemapper are both attempting to massive-scale real world infrastructure (DePIN, Decentralized Physical Infrastructure Networks). I wrote more extensively about Helium about a year and a half ago, but they are attempting to build a global, 5G/Internet of Things network to compete with AT&T/Vertizon/etc. via millions of distributed hotspots. Hivemapper is trying to create Google Maps by having thousands of people drive around with dashcams. It might be just crazy enough to work. Both projects require the speed and low cost nature of Solana, given the high volume of transactions that they are processing to enable their aggressive plans.

But it’s clear we are still in early days. The tech has enabled a whole new world of possible applications, but besides the ability to send millions of dollars anywhere on the planet in seconds for under a penny, those “killer apps” have yet to come. I still think this tech is so different from what has come before and the more different it is, the longer it takes to fully grok and capitalize on its capabilities. I mean, the first email was sent in 1971 and it took 27 years before Meg Ryan caught on so I can’t wait for the Solana rom-com of 2051.

Next issue, we’ll start using Solana ourselves so you can get a taste of it for yourself. Same bat time, same bat channel.

This Week's Burning Hot Take

“Have you ever sent someone a fax… From the beach? You will.”

12/10 on the direction of predictions. 2/10 on who will bring it to you.