The Memes of Production

At my recent business school reunion (I know, it’s hard to believe it’s been five years already!), I was asked to represent crypto on a panel covering “Investing and Financial Planning for the Next 20 Years.” On the panel with me was a super nice, very smart classmate who works for a very large institution where he manages hundreds of billions of dollars across all types of investments. Perhaps not surprisingly, he was broadly dismissive of crypto as an asset class, but his biggest expressed criticism was that crypto was not a “productive” asset: crypto doesn’t “do” anything, doesn’t have cash flows, etc. etc. The panel ended up talking a lot about estate planning and things like that so it never came back around to me, but my biggest regret from reunion weekend (excluding some dance moves on the party bus to the Goose) was that I didn’t get a chance to address this criticism.

I will concede that this is not an unusual argument, but it doesn’t make it any more accurate. And it's a bit disappointing that this perception is so prevalent. But, since I make the big bucks writing this newsletter trying to teach smart, inquisitive people (that’s you) about crypto, I figured I would dedicate this issue to explaining some of the business models, cash flows and, fundamentally, the “productivity” behind crypto.

🟢 Well, Ackchyually

One of the awesome things about crypto is that it is almost completely transparent. In traditional finance, (essentially) only public companies have to issue financials, and then only every three months. In crypto, huge chunks of financial information are default public. And what you see is that even in the midst of “crypto winter,” there are still chains and applications that have real activity and often real cash flows. Almost all of which, with the exception of Bitcoin, aim to be what I would consider “productive” assets.

The table below (data from TokenTerminal.com) shows what users have paid in the last year to use some of the high profile crypto projects. The second column then shows what percentage of those fees the platform has retained as revenue:

You can think of “Total Fees” as the same as AirBnB or Uber’s gross bookings (i.e. how much they collected from end users). “Revenue” is what’s left after you’ve paid out your hosts, drivers, miners, validators, etc. But, hello! People paid $2 billion in real fake money doing stuff on Ethereum in the last year! And the network kept $1.6 billion of that! That sounds like some damn productive monkey JPEGs to me.

🟦 Bitcoin Is Just Different

One of my big take-aways from talking to people at my reunion was that for so many people Bitcoin = Crypto. Like they are just one and the same. I get it, people have only so much time to absorb information and most media attention is focused on Bitcoin. But at this point, Bitcoin is more the exception than the rule. It’s true that Bitcoin mostly does nothing, that’s kind of the whole point. Rather, it’s better to say that Bitcoin does one thing and aims to do it really well: it allows two parties to transfer value globally, quickly and with completely open access. But it’s true: Bitcoin doesn’t pay a dividend, it doesn’t have cash flows, it can’t be used in expensive jewelry.

In fact, the Bitcoin business model is inflationary. As an incentive to process transactions and secure the network, miners get paid in two ways. The first is a “block reward” which is newly issued Bitcoin that goes to the miner that validates (i.e. creates) the most recent block of transactions. This reward started at 50 Bitcoin in 2009 and is cut in half approximately every four years. The current reward is 6.25 BTC or about $180,000. Via the block reward, 900 new Bitcoin are printed every day, an inflation rate of 1.7% But that means you need around $25 million of new investment in Bitcoin every day to keep the price the same. Next April, the reward will get cut in half and the inflation rate will drop to 0.84%. [As a widely unrelated aside, the U.S. government has printed $2 trillion since the debt ceiling was increased four months ago.]

The second way miners get paid are transaction fees. When sending Bitcoin, users can specify a transaction fee based on how quickly they want the transaction included. The current transaction fee average is about $2.50 (a bit cheaper than most wire fees), but this can rise when the network gets busy or fall if your transaction is not a rush. As I write this, there are 27,093 pending Bitcoin transactions waiting to be confirmed. 99.79% of them are offering a transaction fee between 4 and 8 cents. Meanwhile, someone is offering a transaction fee of $1.11 to send $174,506 and that $1.11 fee will almost certainly get priority and be included in the next block.

All of this is to say that, yes, Bitcoin is not a “productive” asset. The fees that users pay leave the system and fund the servers that process transactions. This makes Bitcoin much more akin to gold and is part of the reason that it is widely accepted, even by the SEC, as a commodity instead of a security.

Many of the misunderstandings of crypto stem from the Bitcoin = All of Crypto assumption. Bitcoin uses lots of energy (regardless of various ways this energy is greener than you might think). But Ethereum, and all of the other chains, are 99.95% more energy efficient than Bitcoin and doing a transaction on Ethereum is similar to AWS in energy intensity. Bitcoin can really only send money from one party to another. Etheruem can run code. Once you start to recognize that crypto is much, much more than just Bitcoin, things get a lot more interesting.

◆ Smart and Good Looking, Too?!?

Beyond Bitcoin, you move into the “productive” part of crypto which represents virtually everything else. Fees in Ethereum are a bit different from Bitcoin, but there are parallels. Each transaction includes a “base fee” and then a “priority fee”. The base fee is mandatory and is calculated based on how busy the network is. Users can then add a priority fee (also called a tip), similar to a transaction fee in Bitcoin. The larger the priority fee, the more likely it is to get processed quickly.

Where Ethereum is very different from Bitcoin is where these fees go:

The base fees are essentially used as a stock buyback. 100% of base fees are “burnt” which means that they are removed from the total supply of Ethereum. It’s as if every time an iPhone was sold, most of the profits were used to buy back Apple shares. The effect of this is that Ethereum has been deflationary since “The Merge”. In the past year, the total supply of ETH has shrunk slightly by 0.22%. Whether ETH supply grows or shrinks depends on how busy the network is. It has actually grown slightly in the last month because the network is relatively slow, but most expect that supply will continue to shrink in the future because of this mechanism.

The rest of the fees go to validators, the Etheruem equivalent of miners in the Bitcoin world. Validators receive the variable priority fees (“Don’t forget to tip your validator”), but also receive “issuance rewards” to keep the network running. This is the equivalent of block rewards in the Bitcoin world though the process of distributing these rewards is a bit different. These issuance rewards are where new ETH enter the system.

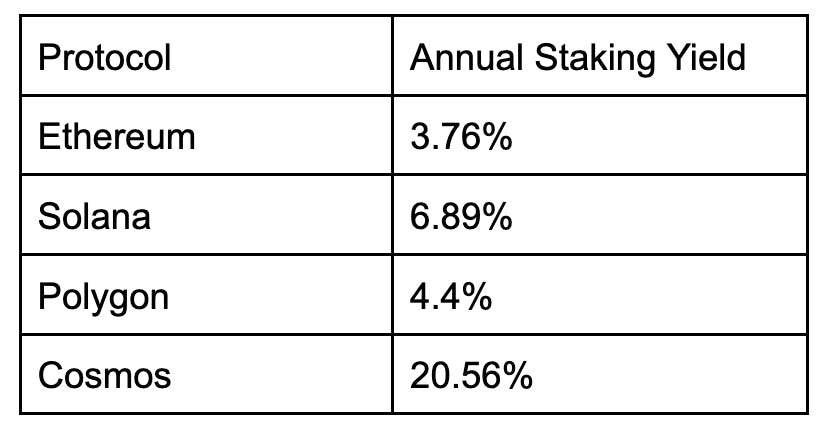

But the difference between miners on Bitcoin and validators on Ethereum (and every other major chain) is that validators mostly pass on their rewards to the owners of the network. Since Bitcoin is “Proof of Work”, those miners are basically burning electricity to prove they aren’t cheating the system. “Proof of Stake” is much more efficient. Instead of doing “work”, validators put up “stake” to prove their legitimacy. Users still own and control their ETH, but they can opt to “delegate” their coins to a validator. Validators take turns processing transactions based on how much ETH they have staked and earn rewards in the process. Those rewards, then get distributed to the stakers with 90-95% of the rewards getting shared out to the owners of the coins. These yields can be significant:

So by holding ETH, not only are you holding an asset that buys back more of its shares than it issues, you can also earn interest on top. That seems productive to me.

◆◆ A Pupu Platter of Apps

Finally, let’s make a distinction between crypto platforms and applications. Most of the attention in crypto is paid to the platforms where a wide variety of transactions take place. These are like the operating systems of crypto. Instead of Windows or Mac OS, there is Ethereum and Solana, each with their own advantages and trade-offs. On top of those platforms run a variety of applications that do different things. And just like in the desktop world, many of these applications run on multiple platforms. You can run PowerPoint on Windows or a Mac and Uniswap exists on eight different blockchains.

We talked above about users staking their Ethereum. Lido is an application that basically does this for you and is an interesting example of how the economics play out. Lido works like this:

Lido takes in Ethereum from users and gives them a synthetic version of Ethereum (stETH) instead that can be converted back and forth at any time.

Lido then runs validators to process Ethereum transactions, thereby earning a stream of fees.

Lido distributes 90% of those fees to stETH holders, keeping 10% for themselves.

You can see the financials behind it. In the last year, Lido earned $530 million in fees and kept $53 million for themselves with which to operate their business. Lido has a token that you can purchase. That token has a fully diluted market cap of $1.5 billion. That means Lido has a Price/Sales ratio of approximately 27x. Snowflake, the publicly traded database company, has a P/S of about 20 right now. Anthropic, the hot AI company, reportedly just raised a round at a 200 P/S ratio. I don’t know if one makes sense and the other doesn’t, but you can value crypto businesses very similarly to traditional businesses.

And like traditional businesses, they may choose to do some non-traditional things. Uniswap is a decentralized exchange that is worth an entire Crypto Curious on its own (foreshadowing perhaps?). It is imaginatively nuanced, but fundamentally allows you to swap one asset for another. In August, it processed approximately $25 billion worth of trades. When we look at its financials, we see that Uniswap has collected about $532 million in trading commissions in the last 12 months (Schwab had $3.6 billion in trading revenue for 2023).

But part of what is interesting about Uniswap is that they kept none of those commissions for themselves. Instead, they pass all of the commission on to what they call “liquidity providers” who supply the assets and liquidity used in the trading. Observers wonder when they will “turn on the fee switch,” but for now they are making a trade-off to prioritize adoption and market share vs. earnings. It’s a bold strategy, let’s see if it pays off for them.

All of this is to say that there is an entire world of crypto beyond Bitcoin, most of which doesn’t really look or act at all like Bitcoin. In fact, it is much closer to traditional technology companies, with their own quirks and oddities, but still highly “productive.”

This Week's Freezing Cold Take

It’s rare that a take can turn freezing cold immediately upon being uttered, but we’ve got a new contender:

“If there hadn’t been a run of customer deposits, they’d still be sitting there making a ton of money.”

-Michael Lewis

This is just dumb and offensive. 1) Banks have runs because they do fractional lending by their nature. You can’t, or rather shouldn’t be able to, have a run on an exchange because they should be in possession of 100% of the assets that they have a duty to be holding for you. 2) It’s not at all clear that FTX was making “a ton of money.” They were certainly spending a ton of money, but there’s a lot more evidence that it was never, in fact, a great business. Lewis has been criticized in the past for “never letting the facts get in the way of a good story,” but you would think he would understand a bit better after 18 months.